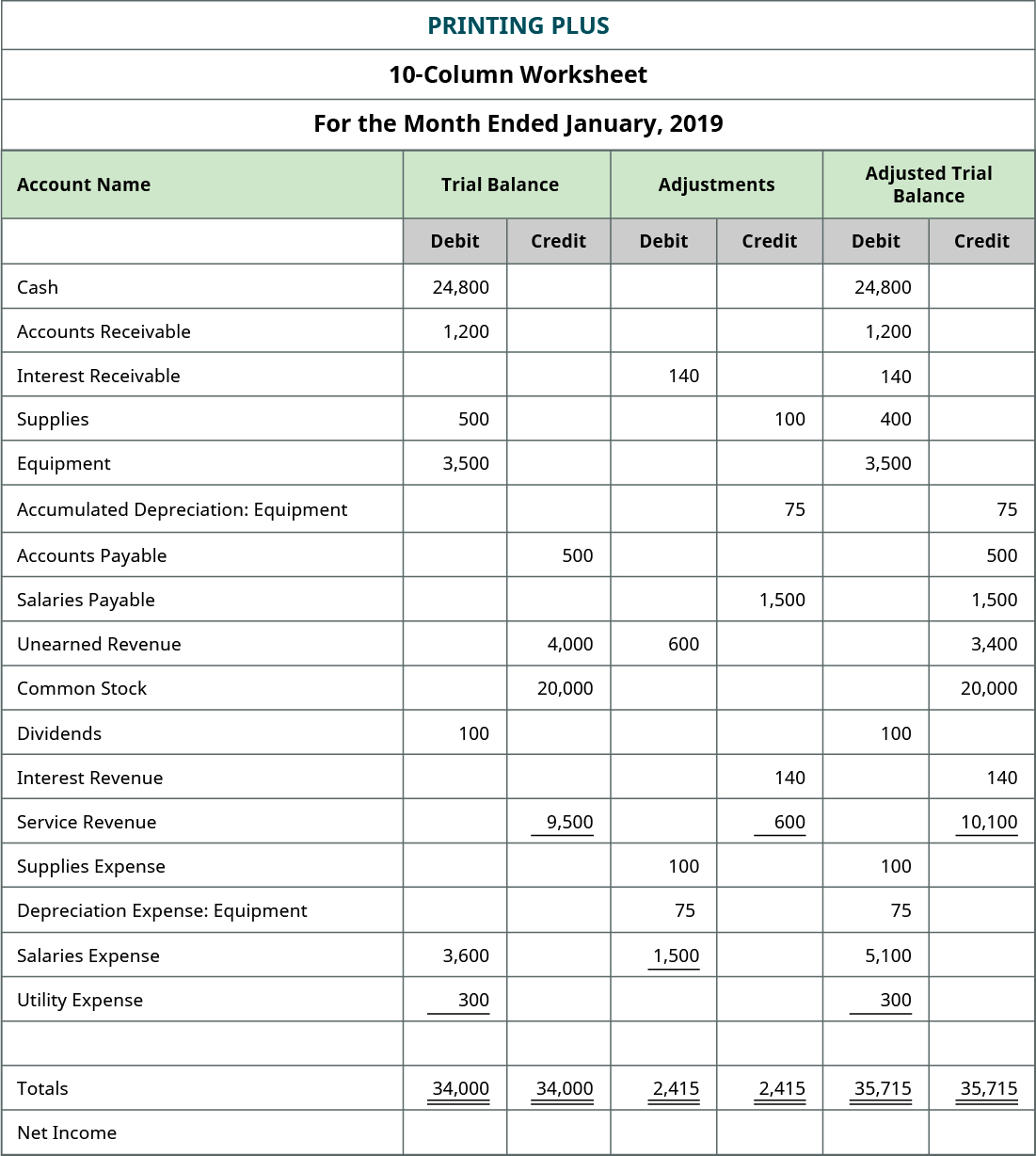

The statement ofretained earnings is prepared before the balance sheet because theending retained earnings amount is a required element of thebalance sheet. The following is the Statement of Retained Earningsfor Printing Plus. Once all balances are transferred to the adjusted trial balance, we sum each of the debit and credit columns. The debit and credit columns both total $35,715, which means they are equal and in balance. Once all balances are transferred to the adjusted trial balance,we sum each of the debit and credit columns. The debit and creditcolumns both total $35,715, which means they are equal and inbalance.

What is an Adjusted Trial Balance?

To prepare the financial statements, a company will look at theadjusted trial balance for account information. From thisinformation, the company will begin constructing each of thestatements, beginning with the income statement. The statement ofretained earnings will include beginning retained earnings, any netincome (loss) (found on the income statement), and dividends. Thebalance sheet is going to include assets, contra assets,liabilities, and stockholder equity accounts, including endingretained earnings and common stock. After analyzing transactions, recording them in the journal, and posting into the ledger, we enter the fourth step in the accounting process – preparing a trial balance. A trial balance simply shows a list of the ledger accounts and their balances.

Frank’s Net Income and Loss

After the closing entries have been made to close the temporary accounts, the report is called the post-closing trial balance. Bookkeepers, accountants, and small business owners use trial balances to check their accounting for errors. The unadjusted trial balance is the initial report you use to check for errors, and the adjusted trial balance includes adjustments for errors. Unearned revenue had a credit balance of $4,000 in the trialbalance column, and a debit adjustment of $600 in the adjustmentcolumn.

Cash or Accrual Basis Accounting?

As you see in step 6 of the accounting cycle, we create another trial balance that is adjusted (see The Adjustment Process). There are no special conventions about how trial balances should be prepared, and they may be completed as often as a company needs them. The next step is to record information in the adjusted trial balance columns. The adjustments total of $2,415 balances in the debit and credit columns. Once the trial balance information is on the worksheet, the next step is to fill in the adjusting information from the posted adjusted journal entries.

This means the $600 debit is subtracted from the $4,000 credit to get a credit balance of $3,400 that is translated to the adjusted trial balance column. The adjusting entries are shown in a separate column, but in aggregate for each account; thus, it may be difficult to discern which specific journal entries impact each account. For instance, in our vehicle sale example the bookkeeper could have accidentally debited accounts receivable instead of cash when the vehicle was sold.

When you prepare a balance sheet, you must first have the mostupdated retained earnings balance. To get that balance, you takethe beginning retained earnings balance + net income – dividends.If you look at the worksheet for Printing Plus, you will noticethere is no retained earnings account. That 10 key bookkeeping tips for self-employed and freelancers is because they juststarted business this month and have no beginning retained earningsbalance. When you prepare a balance sheet, you must first have the most updated retained earnings balance. To get that balance, you take the beginning retained earnings balance + net income – dividends.

But there is some more information required to adjust the trial balance. After incorporating the adjustments above, the adjusted trial balance would look like this. Since most companies have computerized accounting systems, they rarely manually create a TB or have to check for out-of-balance errors. Hence, the trial balance includes all considerable adjustments, which is termed as adjustment trial balance. There are instances when companies end up missing out mentioning the transactions that have occurred in the bookkeeping records. Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS.

In the Printing Plus case, the credit side is the higher figure at $10,240. This means revenues exceed expenses, thus giving the company a net income. If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss. You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575.

- Review the annual report of Stora Enso which is aninternational company that utilizes the illustrated format inpresenting its Balance Sheet, also called the Statement ofFinancial Position.

- You then add together the $5,575 and $4,665 to geta total of $10,240.

- When entering net income, it should be written inthe column with the lower total.

- You then add together the $5,575 and $4,665 to get a total of $10,240.

Income Summary is then closed to the capital account as shown in the third closing entry. Review the annual report of Stora Enso which is aninternational company that utilizes the illustrated format inpresenting its Balance Sheet, also called the Statement ofFinancial Position. What do you do if you have tried both methods and neither has worked?